Introduction

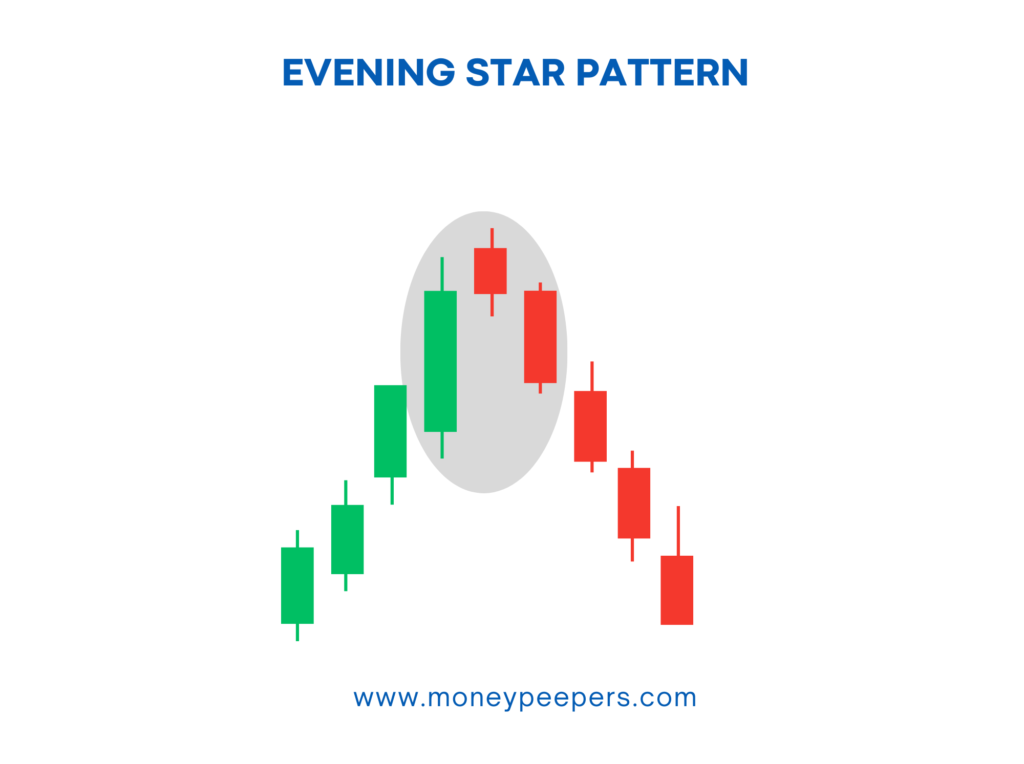

In trading, recognizing when a strong uptrend may be running out of steam is key to protecting profits and avoiding losses. The Evening Star candlestick pattern is a classic warning sign that bullish momentum is fading and sellers could be preparing to take control.

This three-candle pattern forms at the top of an uptrend. It starts with a strong bullish candle, followed by a small-bodied candle (which may be bullish or bearish), and ends with a large bearish candle that closes well into the body of the first. The visual transition reflects growing indecision and a shift in market sentiment—from buyer strength to potential seller dominance. It’s a favorite among traders who watch for signs of a trend reversal and want to get ahead of the curve.

What is the Evening Star Candlestick?

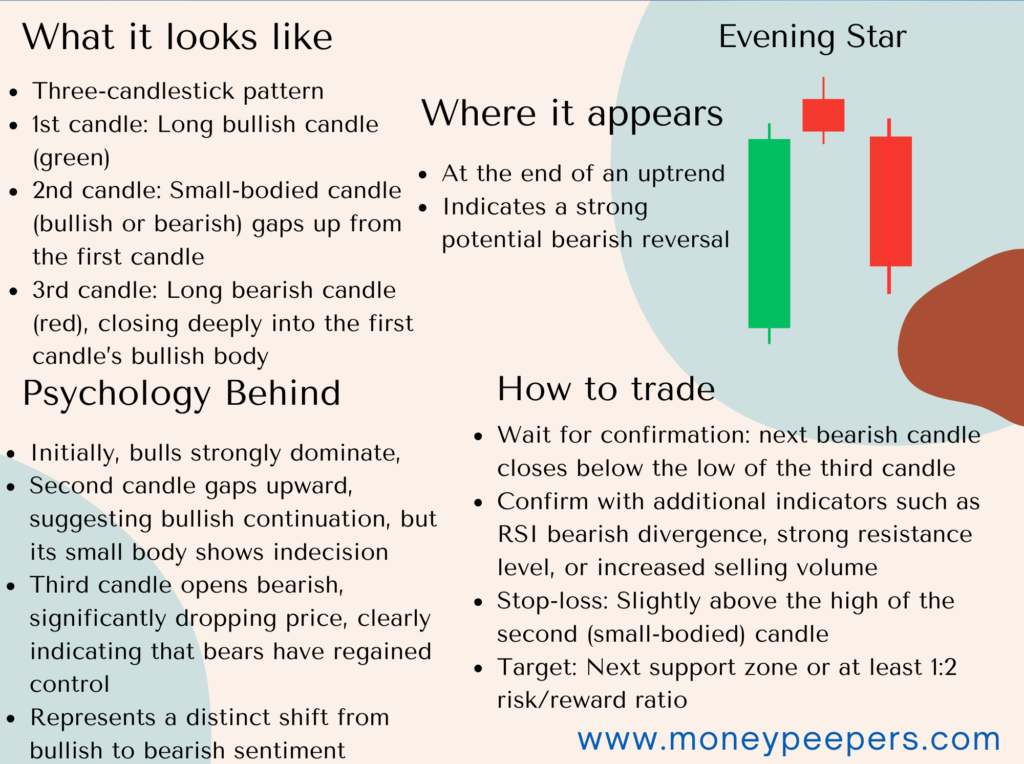

The Evening Star is a bearish reversal candlestick pattern typically formed at the peak of an uptrend, indicating a potential shift from bullish to bearish market conditions.

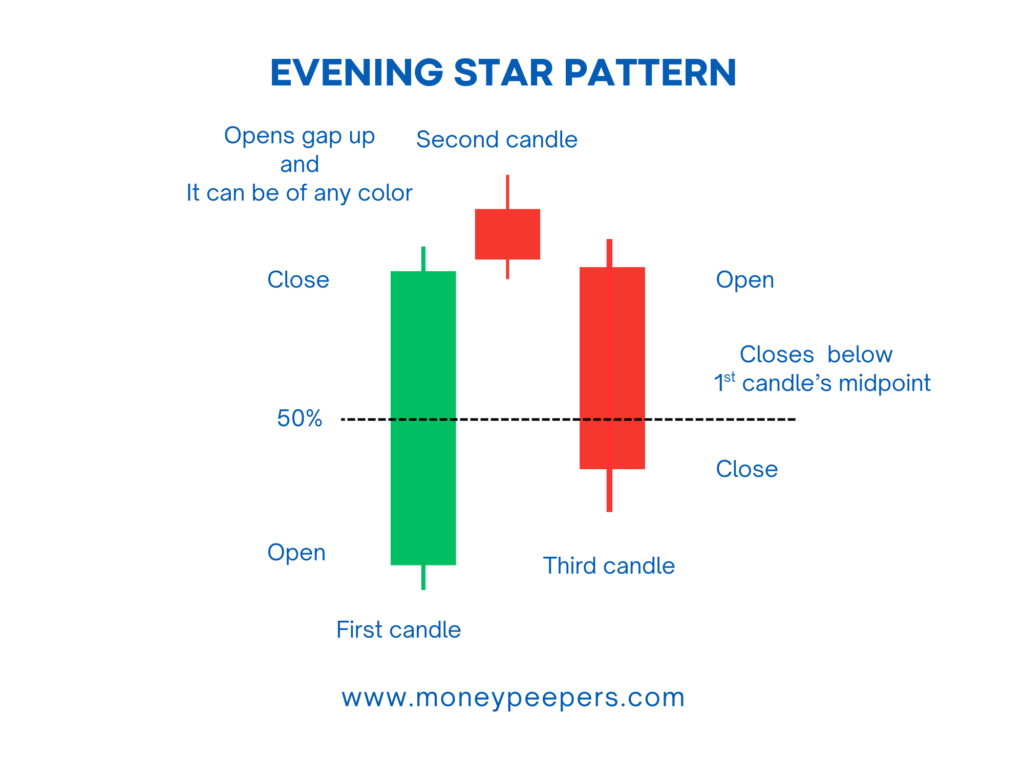

Visual Description and Components:

- First Candle (Bullish): A robust bullish candle representing strong buying pressure and continued upward momentum.

- Second Candle (Star): A small-bodied candle, which can be bullish or bearish, signaling indecision and usually opening with a gap above the first candle.

- Third Candle (Bearish): A substantial bearish candle that closes deeply within the body of the first bullish candle, demonstrating strong selling pressure.

Collectively, these candles form a visually distinctive pattern, suggesting that sellers are beginning to overpower buyers, forecasting potential bearish market sentiment.

Formation & Market Psychology Behind It

The formation of an Evening Star candlestick pattern typically follows a prolonged bullish trend. Initially, bullish sentiment prevails strongly, pushing the price higher, resulting in a significant bullish candle. The subsequent candle, often smaller and gapping higher, reflects market uncertainty, indicating buyers’ reduced confidence. The final candle is bearish, representing renewed selling pressure, driving prices downward significantly and confirming the potential trend reversal.

The psychological shift illustrated by the Evening Star pattern is critical. Initially, optimistic buyers dominate the market, but uncertainty quickly emerges, causing hesitation. As sellers become increasingly active, confidence among buyers deteriorates, and market sentiment decisively shifts from bullish optimism to bearish caution.

Real-world Example:

Consider a situation in which a stock’s price is steadily increasing due to positive financial reports. Traders maintain bullish expectations. Suddenly, a new market development, perhaps regulatory concerns or negative economic news, prompts traders to reconsider. This uncertainty forms the small-bodied candle. As bearish sentiment gains strength, the third candle forms, driving prices lower, confirming the bearish reversal signal provided by the Evening Star pattern.

Key Identification Criteria

To correctly identify the Evening Star pattern, traders should observe these key characteristics:

- Uptrend Requirement: Must occur following a clearly defined uptrend.

- First Candle: A significant bullish candle indicating bullish strength.

- Second Candle: Small-bodied, ideally forming a gap above the first candle, signifying market indecision.

- Third Candle: A large bearish candle closing well into the body of the initial bullish candle, highlighting strong bearish momentum.

It’s essential to differentiate this pattern from the Morning Star, a bullish reversal pattern typically seen at downtrend bottoms.

How to Confirm the Pattern

To improve trading reliability, confirmation after spotting an Evening Star pattern is crucial:

- Subsequent Bearish Candle: A bearish candle closing below the third candle’s low provides a robust confirmation.

- Technical Indicators: High trading volume, bearish divergence on RSI, bearish crossover on MACD, or breaks below critical moving averages further validate the reversal.

For instance, observing a bearish candle with significant volume following the pattern strongly reinforces the bearish outlook.

Trading Strategy Using Evening Star Candlestick

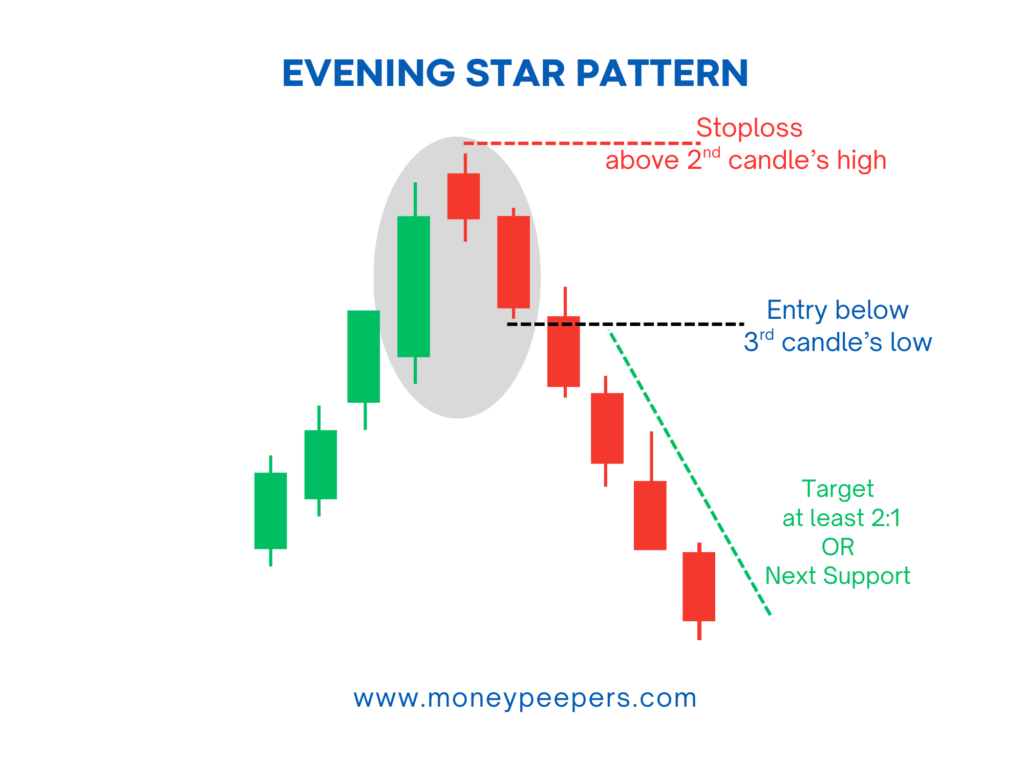

An effective trading strategy utilizing the Evening Star pattern includes defined entry and exit rules:

Entry Point:

Initiate short positions after confirmation, typically when a bearish candle closes below the third candle’s low.

Stop-loss Placement:

- Conservative Approach: Above the high of the second candle (star).

- Aggressive Approach: Slightly above the high of the third candle.

Target/Exit Strategies:

Consider targeting previous support levels, Fibonacci retracement levels, or maintain at least a 1:2 risk-reward ratio.

Position Sizing Tips:

Always manage position sizes according to risk management practices, account size, and risk tolerance.

Chart Examples

Imagine analyzing Bitcoin (BTC/USD) after a prolonged bullish run. An Evening Star pattern forms at a key resistance level. Confirmed by subsequent bearish candles and increasing volume, traders confidently enter short positions. Stop-losses are placed above the pattern’s high, and profit targets set at key support zones, making the trade profitable.

When the Pattern Fails (Limitations & False Signals)

Despite being reliable, the Evening Star pattern may occasionally produce false signals due to:

- Weak Confirmation: Lack of a strong subsequent bearish candle can lead to continued bullish trends.

- Low Volume: Patterns formed on low volume might not represent significant bearish pressure.

Tips to Avoid False Signals:

- Wait for clear bearish confirmation.

- Use complementary indicators for additional validation.

- Exercise caution during uncertain market conditions or sideways trends.

Best Timeframes and Markets to Use This Pattern

- Timeframes: Effective across intraday, daily, and weekly charts, suitable for positional, swing, and day traders.

- Markets: Reliable in stock markets, cryptocurrencies, forex, and commodities, particularly in well-defined trending conditions.

- Trader Suitability: Suitable for both beginner and experienced traders, provided appropriate confirmation and risk management practices are employed.

Tips to Enhance Accuracy

Enhance trading outcomes by:

- Integrating trendlines, support/resistance levels, and volume analysis.

- Utilizing other candlestick patterns or technical indicators such as RSI and MACD.

- Avoiding trading during low-volume or range-bound market conditions to minimize false signals.

Real Trading Example (Optional Case Study)

Suppose a trader observes Apple (AAPL) stock in a strong bullish trend. An Evening Star candlestick pattern appears near an all-time high. Confirmation follows via a strong bearish candle with high volume. The trader enters a short position, placing a stop-loss above the pattern’s high and targets a clear support level. The trade concludes profitably, demonstrating practical application.

Conclusion

The Evening Star candlestick isn’t just another chart formation—it’s a strong indicator that the uptrend may be nearing its end. When supported by resistance levels, declining volume, or confirmation from other technical tools, this pattern becomes a powerful setup for traders looking to lock in profits or prepare for bearish moves.

While it’s important not to act on any pattern in isolation, the Evening Star is reliable when placed in the right context. It’s a pattern that speaks loudly in the language of price action—telling traders, “The tide is turning.” Paying attention to it can help you trade smarter, with more precision and less emotion.

Also Read: Morning Star Candlestick : A Strong Signal For Bullish Reversal

Follow us at X